Last updated on January 22nd, 2019 at 02:08 pm

I’m a writer. I’m a thinker, a creative.

I have a friend who is a CPA. She’s logical. Numbers are her thing.

We make a good pair, Renee and I. There’s never anything to argue about. I know that if numbers are involved, she’s right. And vise-versa.

But reality is that I can’t live with my head in the sand when it comes to numbers. That’s especially so for financial decisions, and especially now that I’m beginning a new life at midlife.

My ex and I did a lot of things right when it came to our financial lives. We paid cash for nearly everything we ever bought. Our house and a car or two were the exceptions. We didn’t use credit cards at all for many years. We kept them for emergencies.

And when we did buy on credit, we quickly paid it off.

When we needed something new, we took advantage of the deals like, 12-months no interest loans. Of course, the credit companies are counting on people who wait until the very last minute to pay them off, and then accrue that ridiculously high interest rate. They lost out on my ex and I.

We even paid our house off. Yeah, I know. I can’t believe how hard I worked to get the house paid off early and now, here I am at the beginning of a 30-year mortgage at midlife!

When the kids were little, I shopped at yard sales and thrift stores. I didn’t do it begrudgingly. I actually liked to see how far I could make my dollar stretch.

I share all of this because it’s important to the financial situation I find myself in now. I’m fortunate, I think. I’m not starting over at midlife with a ton of debt. I’m thankful for that.

Financial Realities of Divorce at Midlife–a Necessary Evil

Maybe you’re like me and you don’t feel like numbers are your thing. When you hear about retirement plans, 401K’s, and investments, you want to run and hide. Me too! But the beautiful thing about being a savvy woman is that we know when to ask for help. Books, magazines, articles, and the internet all provide avenues for educating ourselves. I love this article, 9 SMART Financial Actions for Midlife Women because it lists simple things that every woman should do and know about her finances.

My favorite is #6 “rightsize your life.”

The author describes it as “finding a lifestyle that suits your personal needs, personality, and finances. Suze Orman has a T.V. show, as well as many books on finances. Her book, Women and Money: Owning the Power to Control Your Destiny is particularly helpful to me at this point in my life. Educating yourself isn’t a one-time deal.

It’s ongoing. Realizing that helps you to keep your financial future at the forefront of your thoughts, and in the long run, that will help you achieve the financial freedom you deserve.

My mother always says that the place you can save the most money is in the kitchen. It’s so true, especially when you’re raising three kids who seem to always be hungry (especially the boys). So, I got my free ads in the newspaper and made a list. I cherry-picked the stores; only buying what was on sale – never falling for the end-caps stuffed with goodies that weren’t on sale.

We went for week-long camping trips to the Oregon Coast. It was a pleasant life.

But as the kids got older, something happened. Slowly, my ex and I were making more money. We weren’t rich by any means, I was a public school teacher after-all. But we had enough that money concerns were less and less at the forefront of my thinking.

I got lazy. If I wanted something, I didn’t have to wait until payday. I bought it. I still didn’t charge things to a credit card. But I didn’t wait for sales either.

It happened so slowly that I barely noticed.

Until now.

I’ve been separated/single for two years now. It seems I’ve made a million decisions in the past year. My life has changed drastically. I moved into my new house in June 2014, but as the details were worked out, I paid rent. On March 1st, I made my first mortgage payment. That’s when reality set in. Not only did I make that first payment, but one of six trees looming over my house, began to sway and threaten to fall with every breeze.

Estimates were all about $1,000.

My refrigerator, which is old and came with the house, went on the fritz (it’s still fritzing). The plumbing started leaking so much that the city warned me that I was using a lot of water and probably had a leak somewhere. Oh my!

Starting over at midlife isn’t just about freedom from whatever was bad about your former life. It’s about making it on your own with with whatever resources you have. Depending on how your previous life was lived, the financial responsibilities can range from devastation to major change. In any case, it’s not easy.

So, as I put one foot in front of the other, I am also reaching back; to lessons learned along the way, to words of advice given by others (especially women), and deep into the reservoir of my own common sense and strength I’ve never had to use before. It’s daunting. But I’m determined to make it a challenging game, rather than beating myself up or doubting decisions I know were right.

Financial Priorities for this Midlife Mama:

1. Set mortgage to auto-pay.

2. Set all utilities to auto-pay.

3. Watch weekly sale ads and stock up.

4. Plant a garden.

5. Start making regular payments to Emergency Fund.

6. Decorate my house and yard on within a budget.

7. Look at my monthly bills and decide if I can afford extras like cable T.V.

8. Live a frugal and fun life.

9. Learn to do simple household repairs myself.

10. Maintain home and car systems so they will last longer.

These ten steps will get me started.

But I also have some pressing issues that need to be addressed asap:

• Pest Control (no, not my ex): Last summer, my house and yard were taken over by ants. I never knew how much I hated them. I swear, I’d put out an orange and within seconds, those ants came from nowhere to devour it. In the yard, a minute of yard work, and they were crawling up my feet and pant-legs.

So, I hired an exterminator. It was cheaper on a monthly basis to sign up for a year. And they had a guarantee; if you see another bug, you can call them and they’ll come right back. So I called. And I called. And I called. I was never satisfied. They never really took care of the problem. But every time someone came out, I asked a few more questions. And I learned a lot.

So, this year, I’m doing it myself. That will save money.

• Fridge on the Fritz and Tree Danger: As I assess my current financial issues, I’ve been trying to figure out what to do about my two biggest issues; the tree that needs to be taken out, and my need for a new refrigerator. The tree could pose a serious issue in the near future if it were to fall.

The refrigerator runs constantly, costing money – and it freezes things in the refrigerator. I have to throw out ruined food constantly; dozens of eggs, celery, sour cream, etc. The other day it suddenly occurred to me that I could buy a new fridge on credit. See…I told you I don’t use credit. Didn’t even think of that.

So, I’m now on the lookout for a good deal and one with free interest for 12+ months.

Eyes Wide Open Financial Planning

Right now, I’m simply trying to get used to a new budget; make sure bills are paid on time, that I have enough money in the bank, and that I’ll have money for an emergency if it comes up. But I realize that I’ll have to plan for the future as well. I’m giving myself 6-months on my new budget, and then I’ll look at my financial standing again. I hope to begin putting extra money to principle each month, so my house is paid off earlier than 30-years.

I will also take another look to see if I can put additional money into an emergency fund.

There’s so much to learn and do when it comes to starting over at midlife. Financial issues are right there at the top of the list. By looking at just the next 6-months, I’m allowing myself time to adjust to this new life, while taking steps toward my goal of financial security.

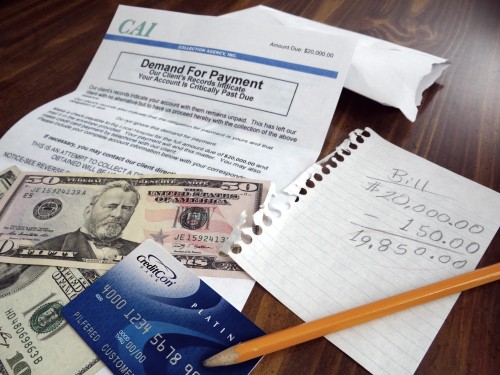

This week, I printed off all of my bank statements. I stacked up my bills and other financial paperwork. I noted when payments were due, when money came in, and when just how much was left for other things, and for the unexpected. At one point, I felt panic set in. I wanted to do what I’m sure many women want to do when faced with uncertainty and doubt.

I wanted to do nothing.

Nothing.

I wanted to put it all away and just get through one bill, one payment…at a time. But I didn’t allow myself to do that. Neither should you.

5 Things You Can do Right Now to Secure Your Financial Future

1. Assess where you are financially.

Don’t be lulled into thinking things will just work out. They won’t. Part of taking control is taking stock of exactly where you are with your money. You can’t make lifestyle adjustments without knowing exactly where you are right now.

2. List 5-10 ways you can save money.

What steps can you take today and in the near future, to ensure your bills will be paid and your financial responsibilities taken care of? It might be as simple as forgoing the drink you always order when you’re out to dinner.

3. Write down your most pressing financial issues (remember my tree and refrigerator examples).

Think creatively about solutions.

4. Start reading up on finances for women.

Check out books from the library. Search the internet or watch financial shows that you would normally click past.

5. Make a budget. Stick to it. Set a timeline.

In my case, my deadline to review my budget is 6-months. You might need to review earlier than that. Whatever the case, mark it on your calendar.

We can do this if we keep our eyes open, see what is there, and then move forward – because even a small step – is a step forward!

Karen Fisher-Alaniz

Starting Over at Midlife

[fbcomments]

Karen Alaniz is a writer, published author, and a home renovation expert now that she’s remodeled an old farmhouse by herself. She strives to help women who are scared it may be too late to start over after a certain age and she encourages empty-nest women to invent a new, prosperous and full life–just like she has done. You can read more about Karen on her Amazon Author page.

Note: Articles by Karen may contain affiliate links and may be compensated if you make a purchase after clicking on an affiliate link.